Uniswap Monthly Financial Report & Analysis - Jan. 2024

This report covers the performance of the Uniswap Protocol and UNI token leading up to and including January 2024.

Table of Contents

Executive Summary

Multichain (Volume, Liquidity, Fees)

Market Share (Volume, Liquidity, Fees)

Layer1 vs Layer2 (Volume, Liquidity, Fees)

Second-Order Values (Protocol Efficiency, Fee Rates, Protocol Yield)

UNI Token

Executive Summary

In January 2024, the Uniswap Protocol processed $46.59 billion in monthly volume (-1.5%) across $4.35 billion in liquidity (+13.4%), earning market makers $70.76 million in fees (-10.6%).

Across all chains, Ethereum saw the most Uniswap volume with $25.9 billion in v3 pools, seconded by Arbitrum. Scroll saw the highest month-over-month growth in volume, liquidity, and fees.

The protocol experienced a relative decline in volume of -0.3% over competing DEX protocols, with a 3.9% relative increase in liquidity and no change in fees collected.

Layer 2 deployments received 34.7% of all Uniswap volume, the highest percentage to date, while claiming an insignificant portion of liquidity (11.2%) and fees (19.85%).

Multichain

Highlighting activity across each major chain with a Uniswap deployment, this section informs on the absolute growth of the Uniswap Protocol and the relative growth across multiple chains.

Only chains with high-quality API data are included.

Volume

The protocol saw a consistent increase in monthly volume from the lows of September 2023 until January 2024, where volume fell 1.5% month over month. Overall, protocol volume is trending upward, and we can expect to see continued growth in the coming months as the market returns to bull market price action and onchain activity.

This month, many recent Unsiwap v3 deployments performed well, with BNB Chain, Scroll, and Rootstock leading the way. Existing major deployments underperformed with Uniswap v2 on Ethereum and v3 on Polygon and Optimism, each falling 15% month over month.

Relatively, Uniswap v2 saw the largest decrease in market share, falling 1.4%, while Arbitrum’s share of protocol volume rose 3% to 24.3% of all trading activity. Since the September lows, Arbitrum has been steadily growing its share of protocol volume and is now by far the leading Uniswap v3 Layer 2 deployment, with Polygon being the next closest at a 5.5% volume share.

Liquidity

The protocol’s liquidity is much more stable than the volume flowing through it. From this year’s low in September 2023 to its high this month, there is only a 36% change compared to the 165% change in volume over the same period.

The Uniswap Protocol saw a yearly high in liquidity, reaching $4.35 billion across all chains and versions this month.

Despite only occupying 8.7% of protocol volume, Uniswap v2 now accounts for 38.6% of liquidity after growing 31.7% to $1.67 billion this month. Uniswap v2’s inability to concentrate liquidity sets itself back from the newer v3 iteration, requiring more liquidity to process the same amount of volume.

The protocol grew deposits 13% this month, with Uniswap v2 leading the way, followed by Ethereum’s v3 instance. The recent deployments performed well, with Scroll growing liquidity 245% month over month, Rootstock growing 89.9%, and BNB Chain growing 23%.

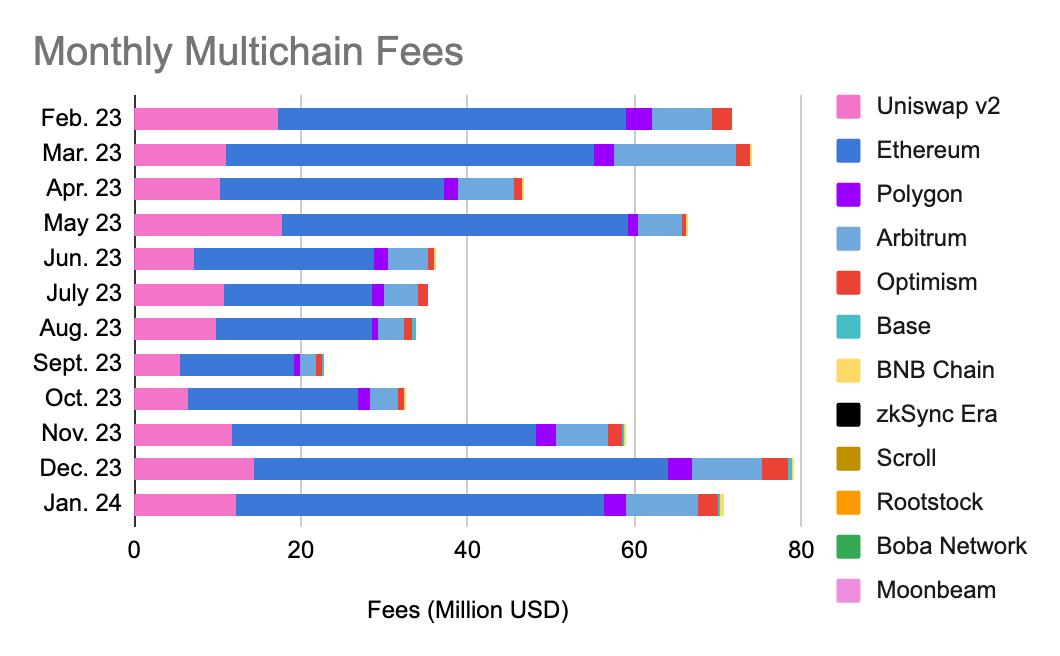

Fees

Unsurprisingly, the Monthly Fee chart trends alongside the Monthly Volume chart. Liquidity providers earned low fees for the year in September of 2023, which rose to December and fell slightly in the first month of January. Since protocol liquidity spiked this month to yearly highs, fees are split between the greater number of pool assets.

Across all chains, fees fell 10.6% month over month, with Optimism seeing the most considerable decrease, down 27.6%. Despite the rough month for liquidity providers, Arbitrum, Scroll, and Rootstock fee collectors saw large increases in earnings alongside the healthy volume increase.

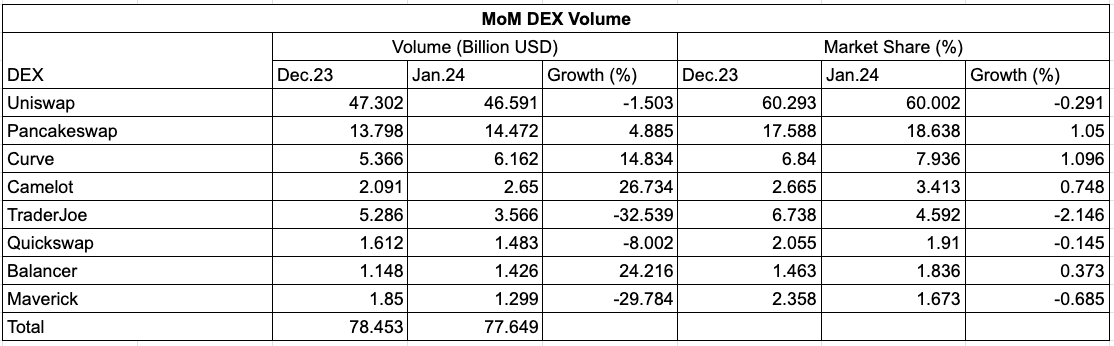

Market Share

This section highlights Uniswap Protocol's success against leading competitors. To be considered a competitor, the protocol must be a spot DEX with at least one deployment on a chain alongside Uniswap v3. To filter out the data, the spot DEX must have a minimum January 2024 volume of $1 billion.

Pancakeswap, Curve, Camelot, TraderJoe, Quickswap, Balancer, and Maverick meet this criterion.

Volume

Month over month, Uniswap Protocol dominance stayed consistent, moving slightly from 60.3% to 60%, with a slight fall in volume shown above.

Camelot was the biggest winner this month, with a 26.7% increase in volume and a 0.7% increase in market share. TraderJoe, on the other side, lost 2.1% market share with a 32.5% volume decrease. Uniswap and Pancakeswap had relatively minor changes compared to the smaller DEXs, experiencing more volume volatility.

Liquidity

Despite processing the majority of volume, Uniswap has a lower TVL than the sum of its competitors. We’ll look further into this phenomenon in the Capital Efficiency section.

In the last month, Uniswap’s liquidity rose 13.3%, led by Uniswap v2 - while competitor liquidity fell 3.5%, increasing Uniswap’s market share by 5.4%.

Uniswap saw the largest increase in liquidity at 13.4% month over month, followed by Curve with 5.0%. Pancakeswap and TraderJoe experienced the most significant outflows at -12.7% and -8.9% respectively.

Compared with the table above, we notice significantly less liquidity volatility than volume.

Fees

Uniswap generated $79 million in fees for its liquidity providers in December 2023, followed by a 10.6% decrease to $70.8 million in January. Despite the drop, Uniswap still holds a 62.8% market share in fees, with competitors only generating 37.2% combined.

Month-over-month fees remained relatively stable in the spot DEX ecosystem on aggregate.

TraderJoe saw the most significant drop in fees (-29.4%) alongside the fall in volume throughout January. Camelot outperformed the rest, growing its fees by 14.7% to a 3.8% market share.

Concerning fee generation for liquidity providers, the Uniswap Protocol remains king.

Layer 1 & Layer 2

This section explores the changes in Uniswap Protocol activity between Layer 1 and Layer 2 deployments as a percentage of total activity. Only Uniswap v2 and v3 on Ethereum are counted as Layer 1 deployments, with Polygon, Optimism, Arbitrum, Base, zkSync, Scroll, Rootstock, Boba and Moonbeam making up the Layer 2 grouping.

Volume

January 2024, Layer 2 was the closest it has ever been to surpassing Layer 1 at 35% of the total volume. Since September 2023, Layer 2 has consistently grown its share; with the protocol's continued growth on Arbitrum and Base, along with new deployment initiatives, we'll be monitoring the volume comparison in the future.

Liquidity

Despite having comparable volume figures, Uniswap Layer 1 deployments have 7.88x more liquidity than Layer 2.

There are a few plausible explanations for the discrepancy, the first being that Uniswap v2 (Ethereum) boasts a 38.6% share of protocol liquidity despite only accounting for 17.1% of volume. On top of that, Arbitrum accounts for 24.3% of protocol volume yet, only 6.6% of liquidity, exacerbating the gap. Until liquidity moves to follow volume, the trend will continue.

Fees

The fee chart trends similarly to volume with lower figures on Layer 2, likely due to Layer 1 volume taking place in high-fee pools.

In January, Layer 1 liquidity providers earned 4.06x more than those on Layer 2.

However, accounting for the difference in liquidity, Layer 2 providers made 94% more per dollar deposited.

Second-Order Values

We analyzed the second-order values of the Uniswap Protocol against its competitors. Uniswap v2 and v3 are divided in these data sets to highlight the differences in design and outcome.

Protocol Efficiency

Protocol efficiency is measured by dividing the total volume by the total liquidity - finding how much volume is generated per dollar of liquidity.

Uniswap v3, Camelot, TraderJoe, and Quickswap perform well in this category, enabling around $20 in volume per dollar of liquidity. Balancer, Curve, and Uniswap v2 fall short with less than $5 per. Maverick outperforms the rest at $40+ of volume per dollar in liquidity.

Fee Rates

The average fee rate is measured by dividing fees by volume - determining the fee rate on each dollar of volume.

Uniswap and TraderJoe have the highest fee rates at 0.3%, the pre-set amount for all v2 pools; the majority of DEXs charge an average pool fee between 0.075% and 0.15%, with Maverick much lower, near 0.02%.

Protocol Yield

A protocol’s yield is found by dividing fees by liquidity - displaying the monthly return per dollar deposited.

Uniswap v3’s liquidity providers earn an average of 2.2% per month, around 3x the earnings of v2 depositors. Curve and Balancer providers earn a low 0.3% and 0.2% respectively, making them the worst liquidity destinations in the group. TraderJoe tops the list at 6.7% monthly returns for providers.

UNI Token

The Uniswap Protocol's governance token, UNI, has performed poorly in the past year relative to the industry mainstays, BTC and ETH. At the end of January 2024, the token was down 11.72% yearly, with BTC and ETH each up by double-digit percentages.

This is not uncommon, as major crypto assets tend to move first in the bull market; we'll be following UNI's price action throughout 2024.

UNI performed at the median compared to its competitors, with most DEX tokens being down 10%. The clear winner over the past year was TraderJoe's JOE token, which rocketed in April of 2023 and returned to similar levels in late 2024, up 100%.

The data from this report was sourced from the Oku API, Oku Analytics, DeFiLlama, and TradingView charting. Subscribe to the newsletter for the February report and more updates on the performance of the Uniswap Protocol across chains and against competitors.