Uniswap Monthly Financial Report & Analysis - July ‘24

This report covers the performance of the Uniswap Protocol and UNI token leading up to and including July 2024.

Table of Contents

Executive Summary

Multichain (Volume, Liquidity, Fees)

Market Share (Volume, Liquidity, Fees)

Layer1 vs Layer2 (Volume, Liquidity, Fees)

Second-Order Values (Protocol Efficiency, Fee Rates, Protocol Yield)

UNI Token

Executive Summary

In July 2024, the Uniswap Protocol processed $59.02 billion in monthly volume (+7.7%) across $6.37 billion in liquidity (-2.1%), earning market makers $76.43 million in fees (-15.1%).

Across all chains, Ethereum saw the most Uniswap volume with $32.57 billion in v3 pools, seconded by Arbitrum. Moonbeam had the highest month-over-month growth in volume and fees.

This month, the protocol experienced a relative decline in volume (-1.8%), liquidity (-0.6%), and fees (-2.8%) over competing DEX protocols.

Layer 2 deployments’ share of volume and liquidity remained flat at 31.0% and 14.6%, respectively, while their fee share grew for the second consecutive month to 22.7%.

This month, the recent Uniswap v3 deployments on Taiko and Sei were added to the report. Uniswap competitor Maverick was replaced by Aerodrome, a much larger protocol as of late.

Multichain

This section highlights activity across each major chain with a Uniswap deployment and informs on the absolute growth of the Uniswap Protocol and its relative growth across multiple chains.

Only chains with high-quality API data are included.

Volume

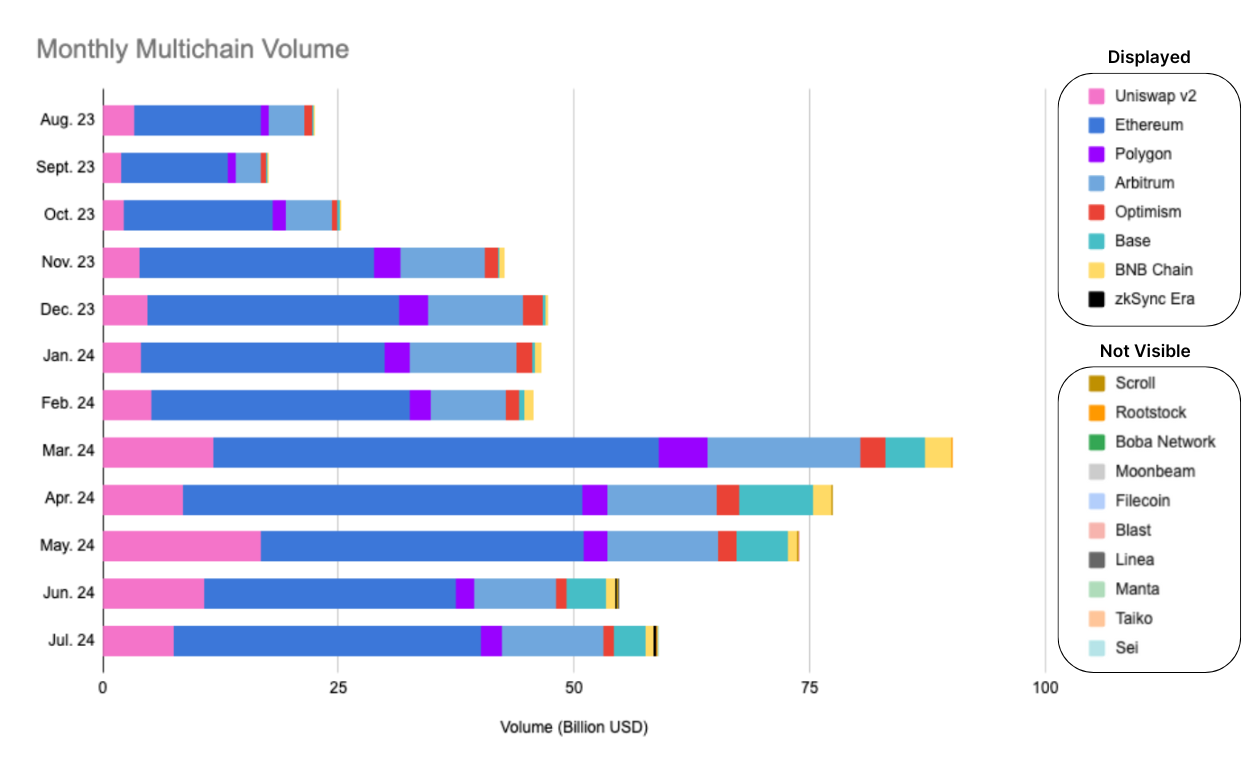

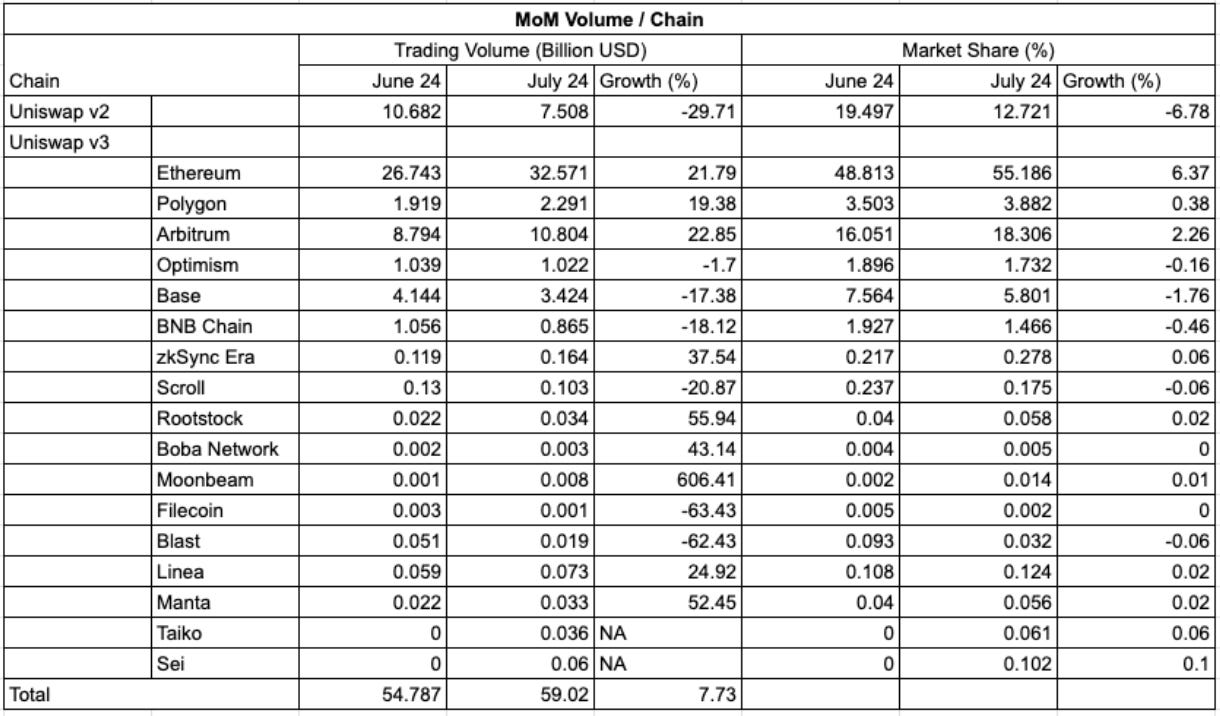

In July, Uniswap protocol volume bounced back slightly after three declining months, rising to $59.02 billion (+7.7%).

July brought high volatility to the largest Uniswap deployments, with only Uniswap v3 Optimism remaining relatively stable month-over-month (-1.7%). Uniswap v2 volume fell 29.7% to $7.51 billion, with Base and BNB Chain marking similar falls. The falls were more than covered by the volume growth on Ethereum’s Uniswap v3 deployment (+21.2%), Polygon (+19.38%), and Arbitrum (+22.85). The launch of UNI incentives on Moonboom welcomed a 606.4% increase in volume, as expected.

Relatively, we see that Uniswap v2’s market share went directly to Uniswap v3 on Ethereum, and Base’s market share was transferred to Arbitrum.

Liquidity

Uniswap protocol liquidity fell slightly to $6.37 billion. Since February, protocol liquidity has fluctuated between $6 billion and $7.2 billion.

This month, liquidity remained relatively stable on the larger protocol deployments but fluctuated on the newer v3 releases. Scroll (-59.97), Blast (-78.2%), and Linea (-71.3%) all took large hits as the UNI liquidity incentives expired. Manta, Moonbeam, and zkSync each grew their liquidity by roughly 20%, helping offset the loss.

As usual there was a very small shift in market share across the board, highlighting the stickiness of liquidity, especially on larger deployments.

Fees

Protocol fees fell once again in July (-15.1%) despite the increase in volume (+7.7%). The fall in Uniswap v2 volume is a big contributor to this decline, as volume appears to be flowing away from the high 0.3% fee-tier pools and towards the lower 0.01% and 0.05% pools offered in Uniswap v3.

Polygon, Arbitrum experienced healthy fee growth in July. As expected, Uniswap v2 fees fell linearly alongside the volume decline, marking a 6.1% fall in market share and a 29.71% fall in fees this month. Moonbeam fees shot up by 447.4% thanks to the UNI incentives. Manta also benefited from the DAO initiative, growing fees by 67.1%.

Uniswap v3 fees on Ethereum fell 8.8% despite a 21.5% rise in volume, indicating that the average fee per trade fell a shocking 25%.

Market Share

This section highlights Uniswap Protocol's success against leading competitors. To be considered a competitor, the protocol must be a spot DEX with at least one deployment on a chain alongside Uniswap v3. To filter out the data, the spot DEX must have a consistent monthly volume of $1 billion.

Pancakeswap, Curve, Camelot, TraderJoe, Quickswap, Balancer, and Aerodrome meet this criterion.

This month, Maverick was removed from the report for failing to capture $1 billion in volume for three consecutive months amidst Aerodrome’s rise.

Volume

Despite increasing protocol volume, Uniswap’s market dominance fell 1.8% to 57.7% in July.

Excluding Curve (-14.4%) and Balancer (-20%), the major DEXs all marked volume increases in July. The biggest winners were Camelot and Traderjoe, who both multiplied their monthly volume threefold, growing their market share by 2% each.

Aerodrome’s volume grew 26.8% in July, while Uniswap v3 on Base saw a 17.4% decrease in the metric. We’ll be monitoring as the two largest DEXs on Base continue to fight for market share.

Liquidity

The Uniswap protocol’s liquidity dominance fell slightly to 52.7% in July. Competitors managed to keep liquidity stable on net, while Uniswap liquidity fell.

This month, the DEX set was composed of four protocols with liquidity growth and four with declining TVL. The protocols that grew the most were TraderJoe with a 17.5% increase in TVL, and Aerodrome with an 11.4% increase.

Fees

Once again this month, the Uniswap Protocol remains the primary hub for fee distribution to liquidity providers. Although the protocol lost a 2.8% market share in July, Uniswap still pays 64.7% of the fees in the competitor set.

TraderJoe’s best month of the year extended to fees generated as well, growing 43.1% month over month. Camelot, also experiencing a 208% increase in volume, grew its fees by 9.6% in July. The two largest protocols, Uniswap and Pancakeswap, both saw a decline in fees generated despite volume growth, highlighting the shift towards lower fee-tier pools on Ethereum and BNB Chain.

Layer 1 & Layer 2

This section explores the changes in Uniswap Protocol activity between Layer 1 and Layer 2 deployments as a percentage of total activity. Only Uniswap v2 and v3 on Ethereum are counted as Layer 1 deployments, with Polygon, Optimism, Arbitrum, Base, zkSync, Scroll, Rootstock, Linea, Blast, Manta, Boba, Taiko, Sei, and Moonbeam making up the Layer 2 grouping.

Volume

Layer 2’s volume share remains flat from March to July at roughly 31% of the total.

Liquidity

Layer 2’s liquidity share remained flat once again in July.

Fees

Layer 2’s share of fees grew by 2.4% in July, continuing the trend back toward the April highs of 29.2%. This shift was primarily driven by the decline of Uniswap v2 fees on Ethereum as opposed to an increase in fees on Layer 2.

Second-Order Values

We analyzed the second-order values of the Uniswap Protocol against those of its competitors. These data sets divide Uniswap v2 and v3 to highlight the differences in design and outcome.

Protocol Efficiency

Protocol efficiency is measured by dividing the total volume by the total liquidity - finding how much volume is generated per dollar of liquidity.

While protocol efficiency remained flat across most protocols in July, the outliers, Camelot and TraderJoe, experienced a massive uptick, from roughly $10 in volume per dollar of liquidity to $27 and $35 per. The remaining DEXs are separated into two tiers at $10 per and $4 per.

Fee Rates

The average fee rate is measured by dividing fees by volume, determining the fee rate per dollar of volume.

Uniswap v2 maintains the highest fee rate at 0.30%, as expected. Uniswap v3’s fee rate decreased, as noticed earlier in the report. Most of the field saw fee rates fall, indicating a shift towards stable pools and away from speculative assets. The exceptions are Balancer and Curve, who each experienced a slight increase.

Protocol Yield

A protocol’s yield is found by dividing fees by liquidity - displaying the monthly return per dollar deposited.

In July, protocol yield remained relatively consistent amongst all DEXs, with the exception of Uniswap v2, which became a significantly worse destination for liquidity providers. Uniswap v3 remains one of the best options, returning a yield of 1.3% in July, similar to Pancakswap, Camelot, and TraderJoe. Curve and Balancer continue to offer the lowest return as their providers deposit into low-volatility pools.

UNI Token

In July, the Uniswap Protocol's governance token, UNI (-22.7%), performed terribly against ETH (-6.9%) and the industry’s largest asset, BTC (+3.9%).

After two months of being the best-performing DEX token in the competitor set, the UNI token performed the worst. The biggest winner was Aerodrome’s AERO token which appreciated 27.2% in the month of July.

The data from this report was sourced from the Oku API, Oku Analytics, DeFiLlama, and TradingView charting. Subscribe to the newsletter for the August report and more updates on the performance of the Uniswap Protocol across chains and against competitors.