Uniswap Monthly Financial Report & Analysis - June ‘24

This report covers the performance of the Uniswap Protocol and UNI token leading up to and including June 2024.

Table of Contents

Executive Summary

Multichain (Volume, Liquidity, Fees)

Market Share (Volume, Liquidity, Fees)

Layer1 vs Layer2 (Volume, Liquidity, Fees)

Second-Order Values (Protocol Efficiency, Fee Rates, Protocol Yield)

UNI Token

Executive Summary

In June 2024, the Uniswap Protocol processed $54.66 billion in monthly volume (-26%) across $6.5 billion in liquidity (-9.6%), earning market makers $89.94 million in fees (-25.5%).

Across all chains, Ethereum saw the most Uniswap volume with $26.74 billion in v3 pools, seconded by Arbitrum. zkSync had the highest month-over-month growth in volume, liquidity, and fees.

This month, the protocol experienced a relative decline in volume (-4.3%), liquidity (-0.6%), and fees (-1.8%) over competing DEX protocols.

Layer 2 deployments’ share of volume and liquidity remained flat at 30.4% and 14.6% respectively, while their fee share grew to 19.9%.

This month, the recent Uniswap v3 deployment on Manta was added to the report.

Multichain

This section highlights activity across each major chain with a Uniswap deployment and informs on the absolute growth of the Uniswap Protocol and its relative growth across multiple chains.

Only chains with high-quality API data are included.

Volume

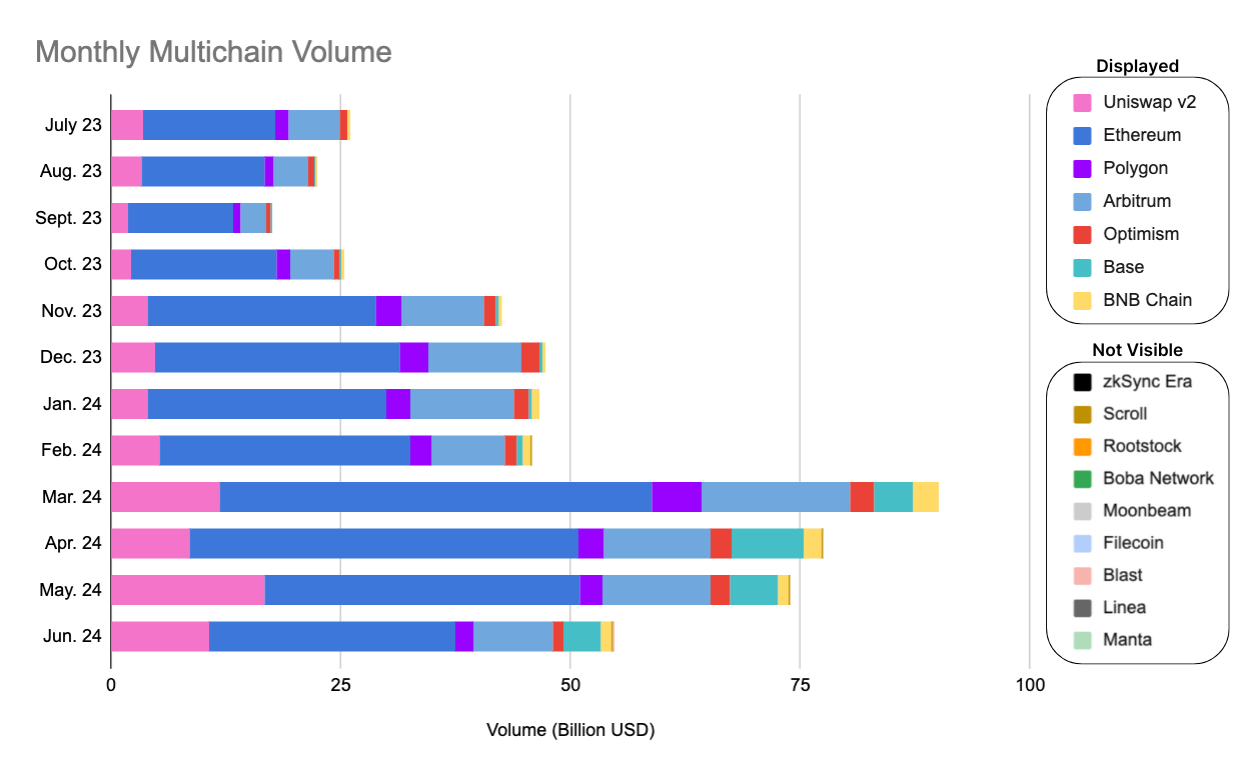

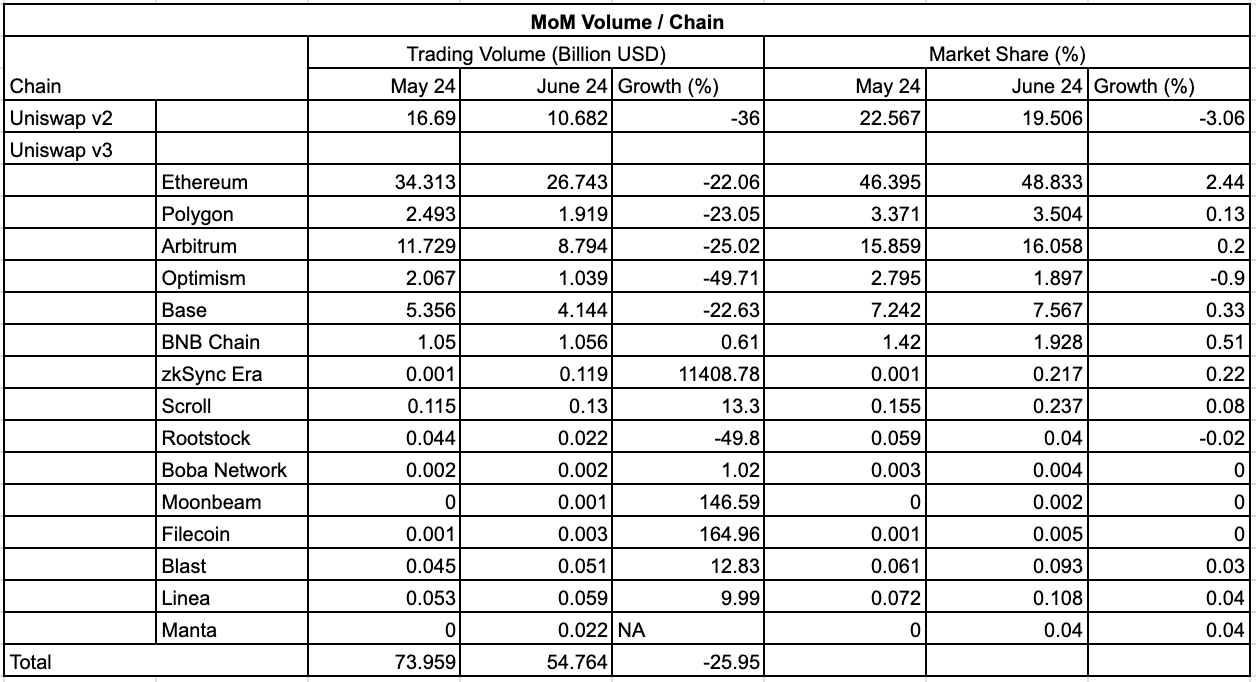

In June, the Uniswap protocol experienced its third consecutive monthly fall, down to $54.66 billion (-26%).

The five largest Uniswap v3 deployments in May, Ethereum, Polygon, Arbitrum, Optimism, and Base, all experienced substantial falls in volume in June, with the best performer being Ethereum, with a shocking 22.1% decline. Uniswap v3 on Optimism performed the worst, with its monthly volume halving to $1.04 billion in June. The best-performing deployments were zkSync, Moonbeam, and Filecoin, each growing by more than 100% - with zkSync marking an 11000% month-over-month increase.

zkSync’s outstanding growth can be attributed to the ZK token launch, UNI liquidity incentives, and the integration on Uniswap Labs’ frontend, forming a perfect storm for protocol activity.

Relatively, Uniswap v2 experienced the largest decline, losing 3.1% of its market share and $6 billion in monthly volume. Despite the 22.1% decline in volume, Uniswap v3 on Ethereum grew its market share by 2.44%, the best of the bad.

Liquidity

Uniswap protocol liquidity fell to $6.5 billion. Since February, protocol liquidity has fluctuated between $6 billion and $7.2 billion.

This month, every Uniswap deployment saw a decrease in liquidity from May, except for those with active UNI incentives. Moonbeam and zkSync each grew their TVL by 800%+, with the incentives going live in June.

Uniswap v2 liquidity fell over $300 million, marking the biggest loss in market share at nearly 1%. Despite the real loss in TVL, v3 on Ethereum grew its market share by 1.1% to 50.1%, now being the home for over half of all protocol liquidity.

Fees

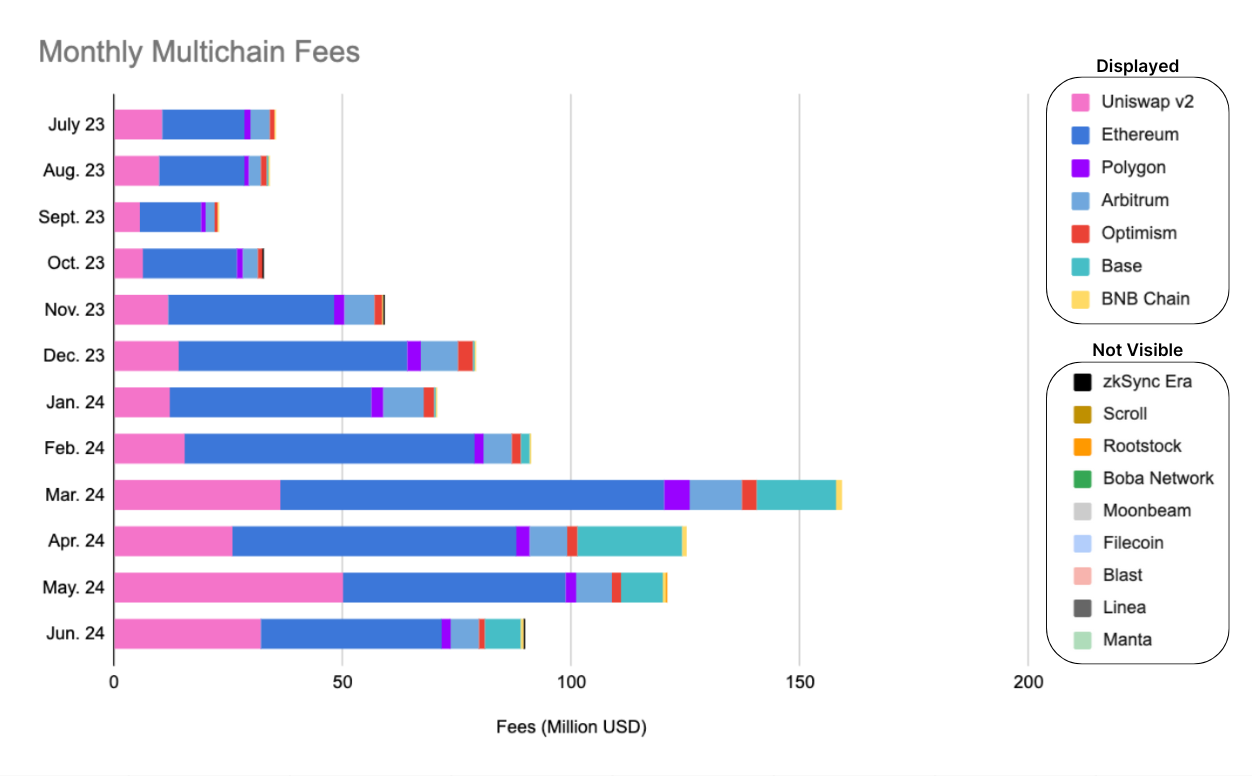

Protocol fees fell heavily in June (-25.5%) alongside the decrease in volume (-26.0%). Uniswap v2 had previously been holding up the protocol’s fee numbers during the recent drops in volume. This is no longer the case, with Uniswap v2 fees underperforming the other deployments with a 36% loss.

Once again, each Uniswap v3 deployment saw metrics fall except for those with liquidity incentives. Most deployment fees fell proportionate to their volume numbers, marking no significant change in pool participation across fee tiers.

zkSync experienced a 15000% increase in fee revenue, 40% higher than the reported volume increase, likely due to the significant ZK volume occurring in 0.3% and 1% pools.

Market Share

This section highlights Uniswap Protocol's success against leading competitors. To be considered a competitor, the protocol must be a spot DEX with at least one deployment on a chain alongside Uniswap v3. To filter out the data, the spot DEX must have a minimum January 2024 volume of $1 billion.

Pancakeswap, Curve, Camelot, TraderJoe, Quickswap, Balancer, and Maverick meet this criterion.

Volume

Uniswap’s volume market dominance fell 4.3% to 62.7% in June.

Amidst the fall off in DeFi activity, the competitor DEX set held up better than the Uniswap Protocol. TraderJoe and Maverick were the exceptions to the rule, with 49.7% and 43.2% declines, respectively. Maverick’s decline can be attributed to the rise of Uniswap v3 on zkSync.

Without a substantial change in volume, Maverick will be removed from the report.

Pancakeswap, Curve, and Balancer held up against the market decline, reclaiming market share from Uniswap.

Liquidity

The Uniswap protocol’s liquidity dominance fell slightly to 55.3% in June.

This is the first monthly fall in Uniswap’s market share since the beginning of this report in January 2024.

This month, every DEX protocol except Curve experienced a fall in liquidity. Curve’s 5.4% growth came with a 2.4% increase in market share over competing protocols. TraderJoe lost half of all protocol liquidity in one month.

Fees

The Uniswap protocol remains the king of fee generation for its liquidity providers, retaining a 70.6% share of fee revenue despite a 1.8% monthly loss in market share.

Every DEX suffered losses in fee collection for liquidity providers this month. Once again, TraderJoe was the worst performer, with a 64.6% fee loss. Pancakeswap held the strongest, growing its share of fees by 3.3% in June.

Layer 1 & Layer 2

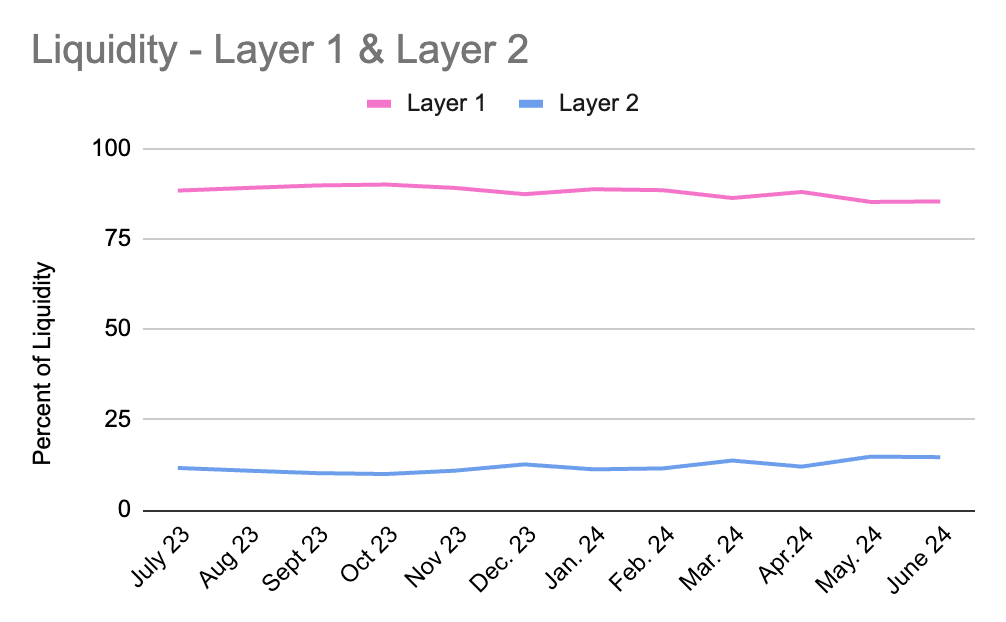

This section explores the changes in Uniswap Protocol activity between Layer 1 and Layer 2 deployments as a percentage of total activity. Only Uniswap v2 and v3 on Ethereum are counted as Layer 1 deployments, with Polygon, Optimism, Arbitrum, Base, zkSync, Scroll, Rootstock, Linea, Blast, Manta, Boba, and Moonbeam making up the Layer 2 grouping.

Volume

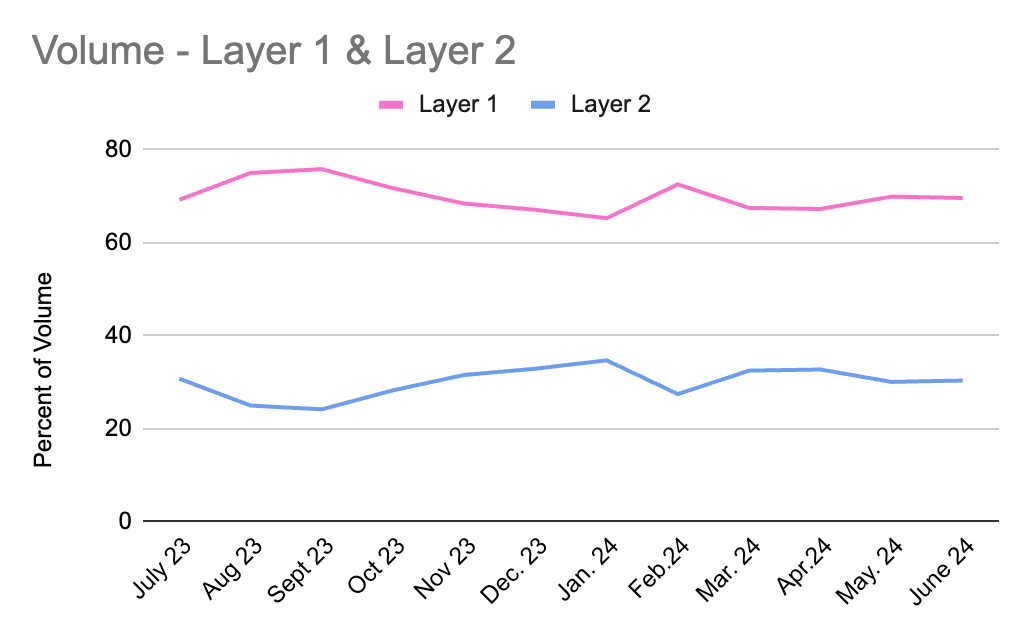

Layer 2’s volume share remained flat from May to June, as volume declines were steady across the protocol.

Liquidity

After reaching an all-time high last month, Layer 2’s liquidity share remained flat in June. Layer 2 liquidity would need to grow by 36% to match the fee distribution, implying that a portion of liquidity on Layer 1 is stale.

Fees

Layer 2’s share of fees grew by 2.1% in June, trending back toward the April highs of 29.2%.

Second-Order Values

We analyzed the second-order values of the Uniswap Protocol against those of its competitors. These data sets divide Uniswap v2 and v3 to highlight the differences in design and outcome.

Protocol Efficiency

Protocol efficiency is measured by dividing the total volume by the total liquidity - finding how much volume is generated per dollar of liquidity.

For the second month running, most DEXs experienced a decline in protocol efficiency, likely due to liquidity movements taking more time than the declines in volume. Most DEXs (Uniswap v3, Pancakeswap, Camelot, TraderJoe, and Quickswap) supported $10 in trading per dollar in TVL. Uniswap v2, Curve, and Balancer were less efficient, and Maverick once again led the pack at over $34 in volume per dollar in liquidity.

Fee Rates

The average fee rate is measured by dividing fees by volume, determining the fee rate per dollar of volume.

Uniswap v2 maintains the highest fee rate at 0.30%, as expected. Uniswap v3’s fee rate increased slightly to 0.13%. Most of the field saw fee rates fall, indicating a shift towards stable pools and away from speculative assets, which is common in times of price decline.

Protocol Yield

A protocol’s yield is found by dividing fees by liquidity - displaying the monthly return per dollar deposited.

Again, in June, protocol yield fell significantly across the board, with fees falling faster than liquidity. The best destinations for liquidity providers continue to be Uniswap v2, Uniswap v3, and Pancakeswap, all returning roughly 1.4% in June. Balancer and Curve offer the lowest returns at around 0.15%.

UNI Token

In June, the Uniswap Protocol's governance token, UNI (-8.2%), performed at par with ETH (-9.8%) and the industry’s largest asset, BTC (-7.2%). As expected, UNI experienced more volatility than the major assets.

Again, in June, Uniswap’s UNI token was the best-performing DEX token in the competitor set, only falling 8.2%. The closest competitor was Quickswap’s QUICK token, which fell by 18% this month.

The data from this report was sourced from the Oku API, Oku Analytics, DeFiLlama, and TradingView charting. Subscribe to the newsletter for the July report and more updates on the performance of the Uniswap Protocol across chains and against competitors.