Uniswap Monthly Financial Report & Analysis - May ‘24

This report covers the performance of the Uniswap Protocol and UNI token leading up to and including May 2024.

Table of Contents

Executive Summary

Multichain (Volume, Liquidity, Fees)

Market Share (Volume, Liquidity, Fees)

Layer1 vs Layer2 (Volume, Liquidity, Fees)

Second-Order Values (Protocol Efficiency, Fee Rates, Protocol Yield)

UNI Token

Executive Summary

In May 2024, the Uniswap Protocol processed $73.96 billion in monthly volume (-4.54%) across $7.19 billion in liquidity (+14.8%), earning market makers $120.82 million in fees (-3.6%).

Across all chains, Ethereum saw the most Uniswap volume with $34.31 billion in v3 pools, seconded by Arbitrum. Linea had the highest month-over-month growth in volume and fees.

This month, the protocol experienced a relative increase in volume (+7.6%), liquidity (+3.1%), and fees (+6.2%) over competing DEX protocols.

Layer 2 deployments’ share of volume and fees fell to 30.0% and 17.8% respectively. However, the deployments reached an all-time high in liquidity share, at 14.8%.

Multichain

This section highlights activity across each major chain with a Uniswap deployment and informs on the absolute growth of the Uniswap Protocol and its relative growth across multiple chains.

Only chains with high-quality API data are included.

Volume

In May, the Uniswap protocol experienced its second consecutive monthly fall, down to $73.96 billion (-4.5%).

Many deployments experienced volatility in their volume figures this month, with Arbitrum, Polygon, and zkSync Era hosting the only deployments with less than a 10% monthly change in volume. Uniswap v2 nearly doubled its monthly volume (+96.5%) alongside Blast (+96.0%) and Scroll (+88.2%). This month's biggest winner was Linea (+254.7%), with the UNI incentives fuelling liquidity growth and downstream volume. Filecoin (-52.4%) and BNB Chain (-45.9%) lost roughly half their April monthly volume.

Relatively, Uniswap v3 grew its market share by 11.6%, now making up roughly a quarter of all Uniswap protocol volume. Uniswap v3 on Ethereum lost 8.2% of its market share, accounting for less than half of protocol volume in May.

Liquidity

Uniswap protocol liquidity reached a yearly high in May, totaling $7.2 billion.

This month, every Uniswap deployment saw an increase in liquidity from April. Blast and Linea had the most significant increases— +224.5% and +171.2%, respectively—largely due to UNI incentives. Base liquidity finally caught up with recent volume flows and nearly doubled to $421.3 million in TVL.

As usual, there were few changes to the liquidity market share. The greatest delta was a 2.32% increase in dominance from Base.

Uniswap v2 and Uniswap v3 on Ethereum hold over 84% of the liquidity.

Fees

Protocol fees fell slightly in May (-3.6%) alongside the decrease in volume (-4.5%). Uniswap v2 deployments helped maintain the protocol’s fee numbers, growing 92.2% with a 20.7% growth in market share.

Multichain fee revenue fluctuated in May due to volume volatility. Base (-60.5%) and Filecoin (-52.4%) liquidity providers lost over half of their fee revenue, while Scroll and Linea providers earned 125.4% and 255.6%, respectively. Regarding market share, these deployments are still a drop in the bucket compared to Uniswap v2’s massive growth mentioned above.

Market Share

This section highlights Uniswap Protocol's success against leading competitors. To be considered a competitor, the protocol must be a spot DEX with at least one deployment on a chain alongside Uniswap v3. To filter out the data, the spot DEX must have a minimum January 2024 volume of $1 billion.

Pancakeswap, Curve, Camelot, TraderJoe, Quickswap, Balancer, and Maverick meet this criterion.

Volume

Uniswap’s volume market dominance rose to 67.0% in May, primarily due to the 31.2% fall in volume from the competitor set.

For the second month running, volume fell on every monitored DEX, with every DEX but Uniswap experiencing double-digit declines. Uniswap’s market share grew 7.6%, holding steadier than the pack. Pancakeswap was the biggest loser, with a 4.7% decline in market share down to $19.91 billion in monthly volume.

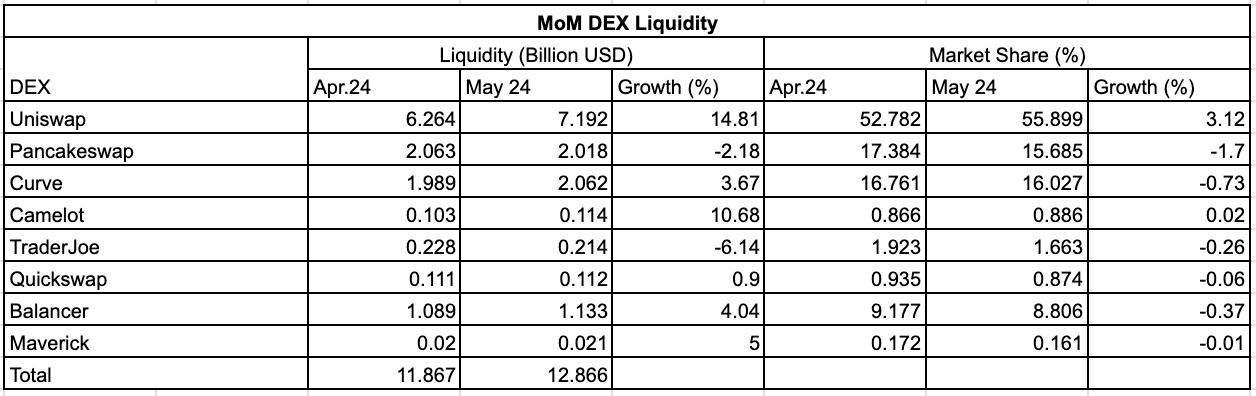

Liquidity

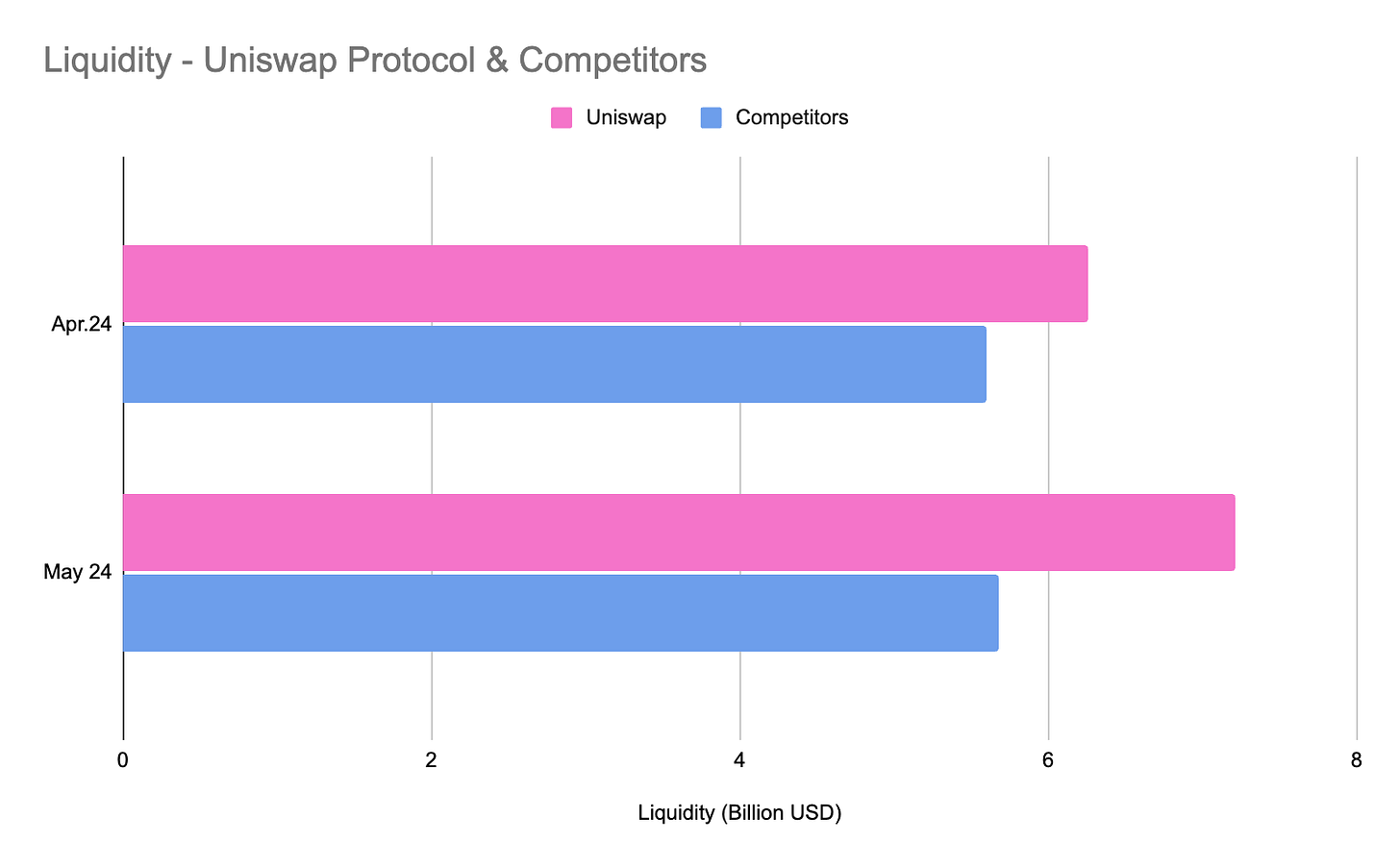

The Uniswap protocol grew its liquidity dominance to 55.9% in May.

Uniswap’s liquidity market share has grown consistently since January, when it was 43.2% of the total.

Uniswap and Camelot were the main liquidity hubs in May, each growing TVL over 10% and seeing growth in market share. TraderJoe and Pancakeswap experienced outflows of 6.14% and 2.18%, respectively - being the only two DEXs to note a decline in TVL along with the fall in volume this month.

Fees

The Uniswap protocol remains the king of fee generation for its liquidity providers, further expanding its dominance to 72.5% this month. Recently, Uniswap v2 has been a significant contributor with its maintained 0.3% fee, as larger assets see volume in 0.01% and 0.05% pools.

Every DEX except Uniswap and Balancer experienced major fee declines, falling more than 20% each. Balancer and Uniswap held on with 2.5% and 3.6% declines, respectively, increasing their market share.

Layer 1 & Layer 2

This section explores the changes in Uniswap Protocol activity between Layer 1 and Layer 2 deployments as a percentage of total activity. Only Uniswap v2 and v3 on Ethereum are counted as Layer 1 deployments, with Polygon, Optimism, Arbitrum, Base, zkSync, Scroll, Rootstock, Linea, Blast, Boba, and Moonbeam making up the Layer 2 grouping.

Volume

Layer 2’s share of protocol volume fell slightly from April to May, now sitting at 30% of the total. Although Uniswap v3 on Ethereum experienced a steep decline in volume, Uniswap v2 overperformed. Base, Layer 2’s fastest-growing deployment, experienced a fall-off for the first time this year.

Liquidity

Layer 2 now holds a yearly high of 14.8% of protocol liquidity, fuelled by Base inflows and UNI-incentivized Layer 2 growth from Scroll, Blast, and Linea. This chart is still extremely flat, highlighting the stickiness of liquidity between chains.

Fees

After hitting an all-time high of 29.2% in April, Layer 2’s fee revenue share experienced a steep decline, falling to 17.8% in May.

Second-Order Values

We analyzed the second-order values of the Uniswap Protocol against those of its competitors. These data sets divide Uniswap v2 and v3 to highlight the differences in design and outcome.

Protocol Efficiency

Protocol efficiency is measured by dividing the total volume by the total liquidity - finding how much volume is generated per dollar of liquidity.

This month, each DEX experienced a decline in protocol efficiency caused by steep declines in volume. Most DEXs (Uniswap v3, Pancakeswap, Camelot, TraderJoe, and Quickswap) supported $10 in trading per dollar in TVL. Uniswap v2, Curve, and Balancer were less efficient, and Maverick once again led the pack at over $40 in volume per dollar in liquidity.

Fee Rates

The average fee rate is measured by dividing fees by volume - determining the fee rate on each dollar of volume.

Fee rates across DEX’s remained relatively flat in May, except for Balancer. Although there was volatility, fees collected and volume moved proportionally, not indicating a large shift in fee tiers. Uniswap v2 maintains the highest fee rate at 0.30%, as expected.

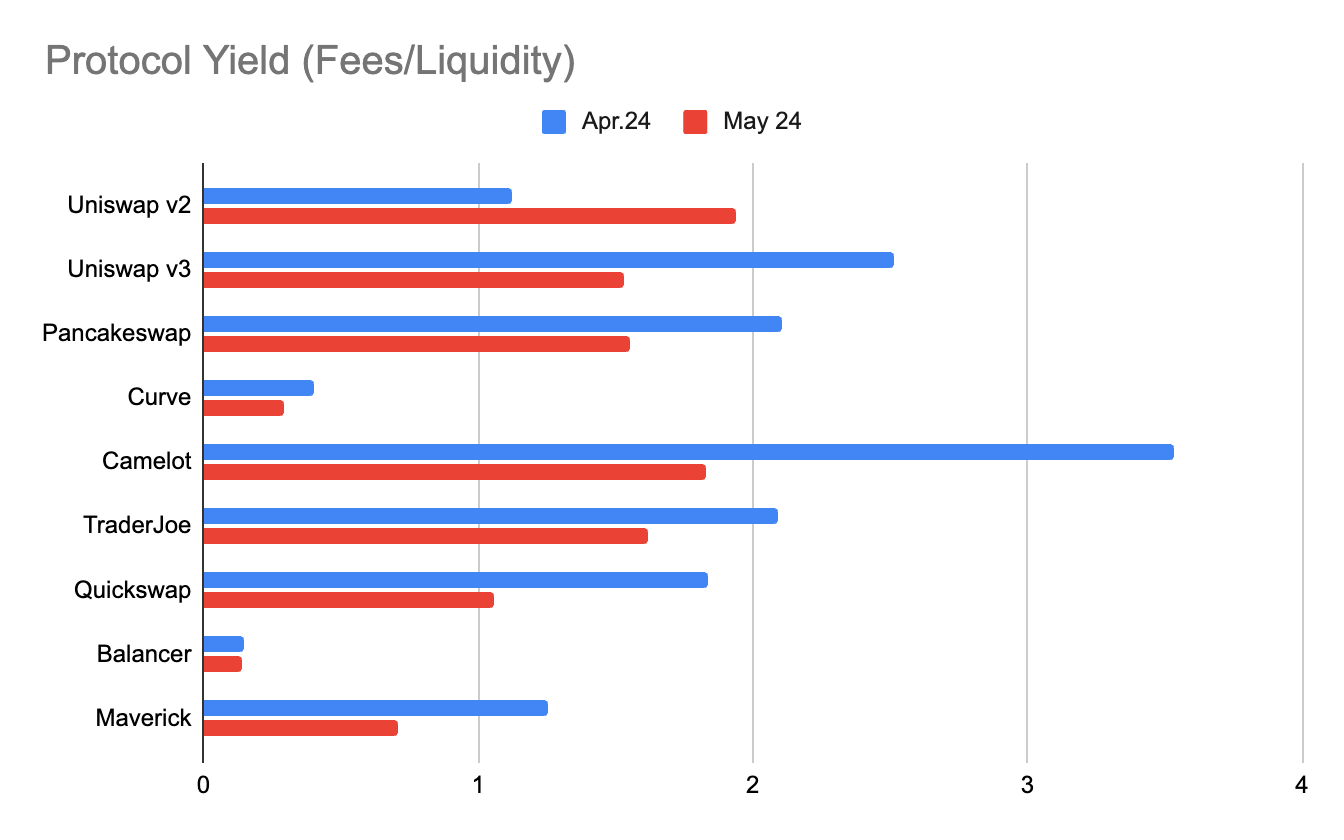

Protocol Yield

A protocol’s yield is found by dividing fees by liquidity - displaying the monthly return per dollar deposited.

Protocol yield fell significantly across the board in May, with liquidity rising and fees falling. The exception to the rule was Uniswap v2, where despite the capital inefficiency of constant product AMMs, liquidity providers earned 1.9% this Month - more than any other DEX.

Since the launch of this report, this is the first time that Uniswap v2 has had a higher protocol yield than Uniswap v3, let alone the highest of all the DEXs.

Interestingly, despite Maverick's extremely high volume-to-liquidity ratio, the protocol offers very low yields for liquidity providers.

UNI Token

In May, the Uniswap Protocol's governance token, UNI (+40.5%), significantly outperformed ETH (+28.5%) and the industry’s largest asset, BTC (+16.2%).

Recent volatility has been primarily driven by speculation around the Uniswap protocol fee switch, which would enable UNI stakers to earn on protocol volume.

Uniswap’s UNI token was the best-performing DEX token in the competitor set, with the second-best being Maverick’s MAV token (+14.8%), still more than 25% away.

The data from this report was sourced from the Oku API, Oku Analytics, DeFiLlama, and TradingView charting. Subscribe to the newsletter for the June report and more updates on the performance of the Uniswap Protocol across chains and against competitors.