Uniswap Monthly Financial Report & Analysis - October ‘24

This report covers the performance of the Uniswap Protocol and UNI token leading up to and including October 2024.

Table of Contents

Executive Summary

Multichain (Volume, Liquidity, Fees)

Market Share (Volume, Liquidity, Fees)

Layer1 vs Layer2 (Volume, Liquidity, Fees)

Second-Order Values (Protocol Efficiency, Fee Rates, Protocol Yield)

UNI Token

Executive Summary

In October 2024, the Uniswap Protocol processed $48.24 billion in monthly volume (+20.2%) across $5.73 billion in liquidity (+2.8%), earning market makers $80.30 million in fees (+30.1%).

Across all chains, Ethereum saw the most Uniswap volume with $24.83 billion in v3 pools, seconded by Arbitrum. Each of the major deployments except for Arbitrum saw increases in volume and fees.

This month, the protocol experienced a relative decline in volume (-3.9%) and fees (-3.8%) over competing DEX protocols, with a slight increase in liquidity (+0.4%).

Layer 2 deployments’ share of volume and fees fell this month, while their liquidity share rose slightly for the second consecutive month.

This month, the recent Uniswap v3 deployments on Gnosis and BOB were added to the report.

Multichain

This section highlights activity across each major chain with a Uniswap deployment and informs on the absolute growth of the Uniswap Protocol and its relative growth across multiple chains.

Only chains with high-quality API data are included.

Volume

Uniswap protocol volume bounced back this month, rising 20.2% to $48.24 billion.

(Only chains with visible volume figures are displayed)

There were significant changes in volume this month across the different Uniswap v3 deployments. Many of the major chains, Ethereum, Polygon, Optimism, Base, and BNB Chain, experienced significant growth, with the lowest performer being Ethereum, which had a 19.6% monthly growth rate. The exception was Arbitrum, which dropped its monthly volume by 23.3%, losing 6.6% of its market share.

Uniswap v2 was the biggest winner this month, growing its volume by 54.8% and its market share by 5.2%. Uniswap v2 now accounts for nearly a quarter of all Uniswap protocol volume. Typically, Uniswap v2 is home to high-risk assets such as memecoins. This extreme growth may highlight a shift towards more speculative trading on Ethereum.

Liquidity

After a significant falloff in August, Uniswap protocol liquidity has been growing for two consecutive months to $5.73 billion. Liquidity figures are still substantially below the Q2 2024 values but could return to the $6 billion to $7 billion range in the coming months as markets heat up.

(Only chains with visible liquidity figures are displayed)

Liquidity remained relatively stable across all major Uniswap v3 deployments except Polygon, which experienced a shocking 31.1% increase in October. Polygon’s notable liquidity growth was likely influenced by Polymarket capturing millions of eyeballs and billions in transaction volume surrounding the US presidential election.

Many of the smaller Uniswap v3 deployments struggled with liquidity this month, with Rootstock, Filecoin, Taiko, Sei, and Mantle all marking 50%+ drawdowns in TVL.

Fees

In October, protocol fees rose to levels not seen since June 2024. The 30.1% increase was primarily fuelled by Uniswap v2, which experienced a 54.8% increase in fees distributed this month.

(Only chains with visible fee figures are displayed)

October was a good month for Uniswap v3 liquidity providers on Polygon zkEVM (+134.8%) and Base (+142.1%), with both chains more than doubling their monthly fees collected. With this move, Base surpassed Arbitrum as the chain with the second most fee distribution to liquidity providers, following only Ethereum.

Uniswap v2 grew its fee figures by 54.8% to $33.97 million this month and is close to flipping Uniswap v3 on Ethereum in fee market share.

Market Share

This section highlights Uniswap Protocol's success against leading competitors. To be considered a competitor, the protocol must be a spot DEX with at least one deployment on a chain alongside Uniswap v3. To filter out the data, the spot DEX must have a consistent monthly volume of $1 billion.

Pancakeswap, Curve, Camelot, TraderJoe, Quickswap, Balancer, and Aerodrome meet this criterion.

Volume

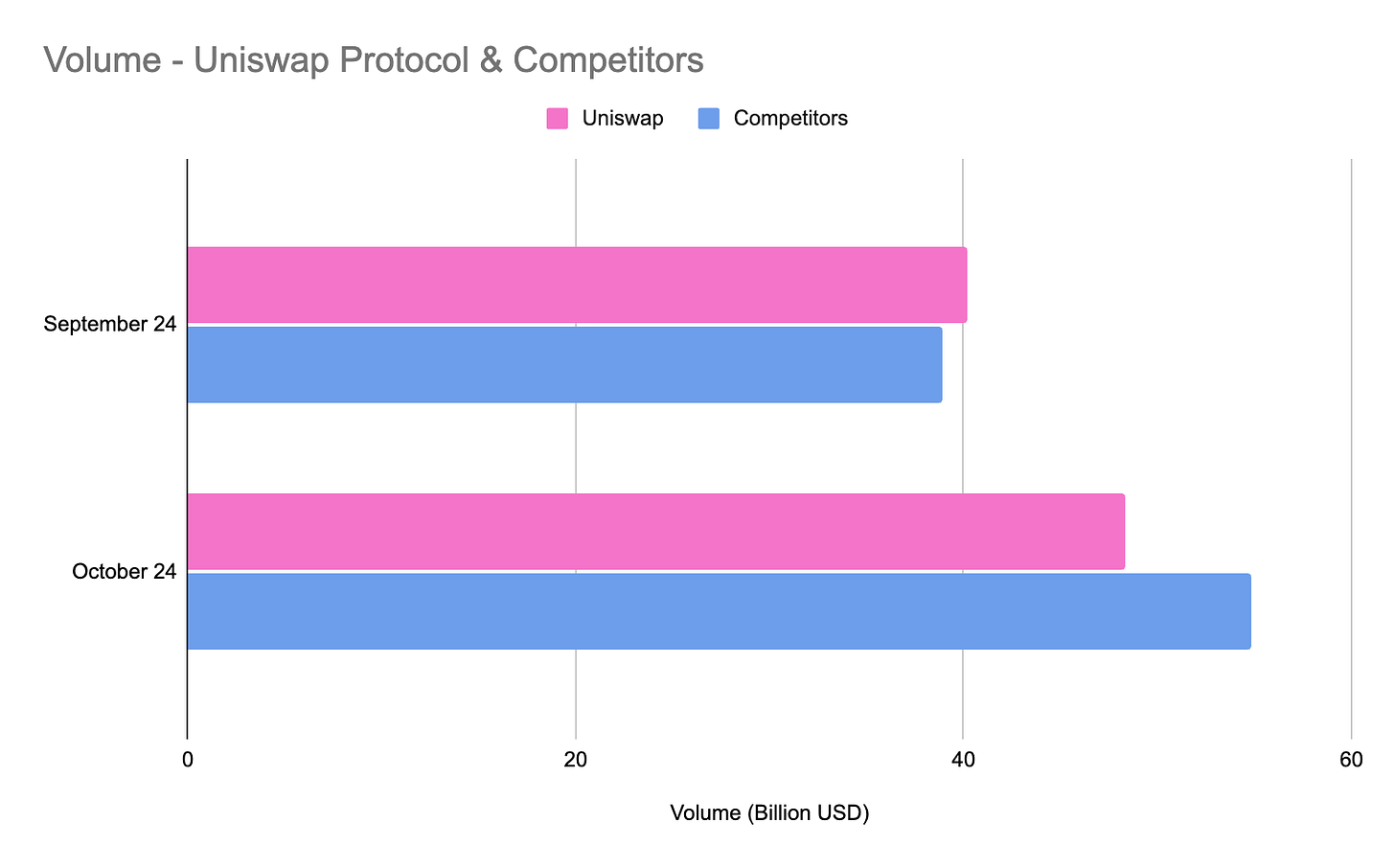

Uniswap’s volume dominance declined once again in October. Although both Uniswap and the competitor set grew their volume this month, Uniswap’s was less significant (20.2% vs 40.1%).

Every DEX in the competitor set welcomed more volume in October than in September. The top performer was Aerodrome, growing their monthly volume by 83.2% to $16.52 billion. This move led the DEX to capture 4.6% more market share directly from the Uniswap protocol. The worst performer was TraderJoe, who kept volume figures flat in an active month for onchain trading.

Liquidity

The Uniswap protocol maintained its 48.6% share of DEX liquidity in October, with a slight increase in TVL that matches the competitor set.

Once again in October, Aerodrome was the biggest destination for new liquidity, growing a shocking 22.8% to $1.4 billion in protocol TVL. TraderJoe was the other home for new liquidity, with TVL growing 8.3% this month despite being the only DEX without a notable rise in volume.

Curve (-8.7%) and Quickswap (-8.6%) saw the largest outflows this month. With Uniswap v3 on Polygon being a prominent destination for new liquidity in October, it’s safe to say that several Quickswap liquidity providers moved funds to the leading DEX protocol.

Fees

Both Uniswap and the competitor set experienced a large fee increase this month. Unfortunately for the leading protocol, the competitor set increased fees by 52.8%, shrinking Uniswap’s dominance by 3.5% on the month.

TraderJoe returned 176.1% more fees to liquidity providers in October than in September despite maintaining extremely similar volume figures. Pancakeswap and Aerodrome each grew their collected fees by 50%, picking up 3.8% of the market share from Uniswap this month.

Layer 1 & Layer 2

This section explores the changes in Uniswap Protocol activity between Layer 1 and Layer 2 deployments as a percentage of total activity. Only Uniswap v2 and v3 on Ethereum are counted as Layer 1 deployments, with Polygon, Optimism, Arbitrum, Base, zkSync, Scroll, Rootstock, Linea, Blast, Manta, Boba, Taiko, Sei, Mantle, Polygon zkEVM, Lisk and Moonbeam making up the Layer 2 grouping.

Volume

Layer 2’s volume share dropped to a yearly low in October, now only making up 23.1% of all protocol trading. Arbitrum’s October decline, alongside Uniswap v2’s growth, are the big contributors to this change.

Liquidity

Layer 2’s liquidity share grew by 0.4% in October, again highlighting that liquidity doesn’t directly follow volume.

Fees

Following volume, Layer 2’s share of fees fell by 1.2% to just 13.5% of the total.

Since beginning this report in January 2024, October is the first month where Layer 2’s have a higher share of liquidity than fees, highlighting that Layer 1 providers are now earning more yield per dollar in the protocol.

Second-Order Values

We analyzed the second-order values of the Uniswap Protocol against those of its competitors. These data sets divide Uniswap v2 and v3 to highlight the differences in design and outcome.

Protocol Efficiency

Protocol efficiency is measured by dividing the total volume by the total liquidity - finding how much volume is generated per dollar of liquidity.

Protocol efficiency was relatively stable in October, with subtle increases thanks to a rise in onchain volume. Camelot’s concentrated liquidity protocol still provides the most volume per dollar in TVL, now facilitating $31.97 in volume per dollar.

Fee Rates

The average fee rate is measured by dividing fees by volume, determining the fee rate per dollar of volume.

Uniswap v2 maintains the highest fee rate at 0.30%, as expected. The remainder of the fee rates remained relatively flat, with a stunning increase from TraderJoe. As mentioned earlier in the report, TraderJoe fees grew over 176.1% despite no changes in volume. Uniswap v3, Pancakeswap, and TraderJoe now have similar average fee rates, between 0.12% and 0.16%.

Protocol Yield

A protocol’s yield is found by dividing fees by liquidity - displaying the monthly return per dollar deposited.

Liquidity providers across the major DEXs performed much better in October than in September. Without surprise, TraderJoe skyrocketed from offering 1% per month in average yield to 2.6%. Pancakeswap also crossed the 2% monthly yield threshold, with Uniswap v2 not far behind at 1.9%.

Uniswap v3, Camelot, and Quickswap remained consistent at just over 1% on the month.

UNI Token

The Uniswap Protocol's governance token, UNI (+9.93%), had a great month in October, outperforming ETH (+2.56%), but falling short against the industry’s largest asset, BTC (+14.27%).

Uniswap’s UNI token was the best performer this month, closely seconded by Aerodrome’s AERO token (+8.91%). October marks the second consecutive month where the top performing tokens are AERO and UNI.

Each other token in the competitor set was down in October despite BTC’s substantial rise.

The data from this report was sourced from the Oku API, Oku Analytics, DeFiLlama, and TradingView charting. Subscribe to the newsletter for the November report and more updates on the performance of the Uniswap Protocol across chains and against competitors.